Solar Photovoltaic (PV) Installation in Carmarthenshire

The owners of this large domestic property in Carmarthenshire are very conscious of the carbon footprint of their property and having previously installed renewable technologies, namely an air source heat pump and a solar thermal panel hot water system, and they wished to offset running costs of their property even further.

The owners of this large domestic property in Carmarthenshire are very conscious of the carbon footprint of their property and having previously installed renewable technologies, namely an air source heat pump and a solar thermal panel hot water system, and they wished to offset running costs of their property even further.

The Problem:

The client liked the ideal of solar photovoltaic panels but didn’t have much roof space due to the unique shape of their roof, which has several large roof windows, and due to the positioning of the solar thermal panels.

The client liked the ideal of solar photovoltaic panels but didn’t have much roof space due to the unique shape of their roof, which has several large roof windows, and due to the positioning of the solar thermal panels.

The available roof space and its unique shape made a roof mounted solar PV system untenable, however the property has large grounds and the owners were still very keen on installing solar PV system to offset their running costs.

WDS Green energy suggested a ground mounted array on some of the unused land of this large property grounds to achieve the owner’s renewable desires without impacting upon the appearance to the property.

The Solution:

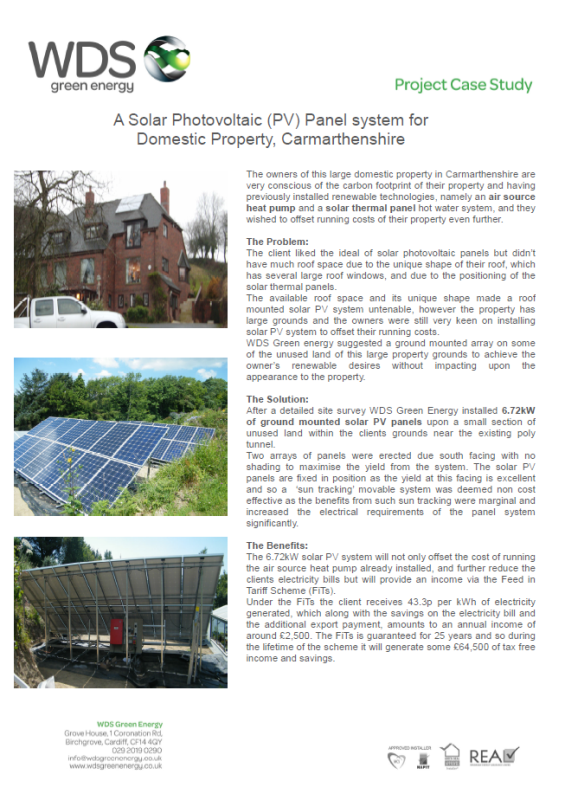

After a detailed site survey WDS Green Energy installed 6.72kW ground mounted solar PV panels upon a small section of unused land within the clients grounds near the existing poly tunnel.

After a detailed site survey WDS Green Energy installed 6.72kW ground mounted solar PV panels upon a small section of unused land within the clients grounds near the existing poly tunnel.

Two arrays of panels were erected due south facing with no shading to maximise the yield from the system. The solar PV panels are fixed in position as the yield at this facing is excellent and so a ‘sun tracking’ movable system was deemed non cost effective as the benefits from such sun tracking were marginal and increased the electrical requirements of the panel system significantly.

The Benefits:

The 6.72kW solar PV system will not only offset the cost of running the air source heat pump already installed, and further reduce the clients electricity bills but will provide an income via the Feed in Tariff Scheme (FiTs).

The 6.72kW solar PV system will not only offset the cost of running the air source heat pump already installed, and further reduce the clients electricity bills but will provide an income via the Feed in Tariff Scheme (FiTs).

Under the FiTs the client receives 43.3p per kWh of electricity generated, which along with the savings on the electricity bill and the additional export payment, amounts to an annual income of around £2,500. The FiTs is guaranteed for 25 years and so during the lifetime of the scheme it will generate some £64,500 of tax free income and savings.